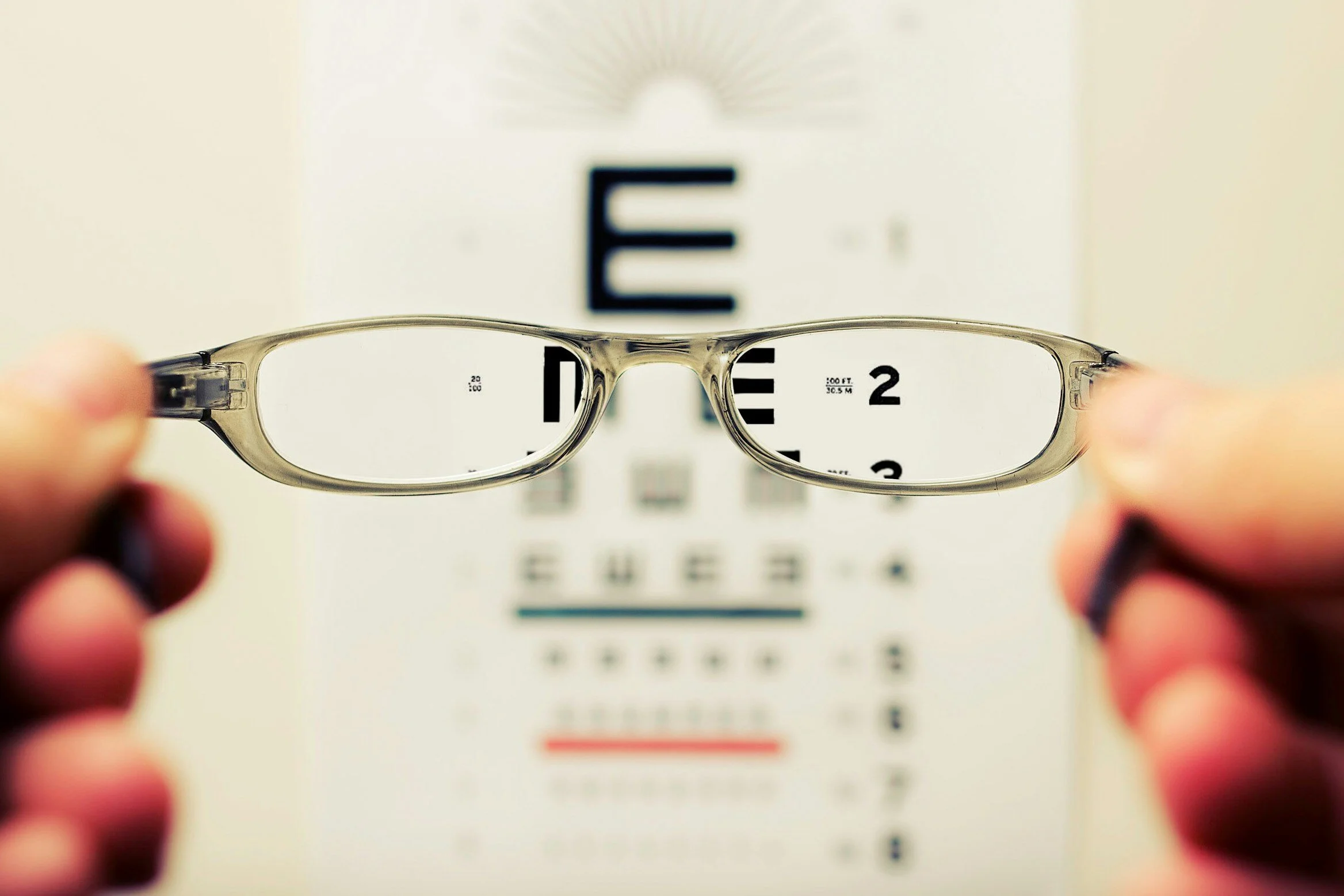

Keep your eyes in check with vision coverage

Vision coverage for eye glasses lenses and frames, contacts lenses, and eye exams is crucial for maintaining good eye health. Regular eye exams are essential for detecting any potential issues early on. However, the cost of these services can add up quickly, making vision coverage a valuable investment. Whether it's for prescription lenses, trendy frames, or comfortable contact lenses, having coverage can help offset the expenses and ensure that you can access the eyecare you need without breaking the bank. Prioritizing vision coverage can save you from unexpected and costly out-of-pocket expenses while safeguarding your precious eyesight.